Exciting Changes Are Coming to Claxton: Please pardon our progress as we renovate our Claxton Main Branch location. – The Claxton Main Branch will be closed for renovations starting October 13, 2025. We expect to reopen in fall 2026 with a fresh new look and improved customer experience. During this time, our Bellville Branch located at 1433 Bernie Anderson Hwy, Bellville, GA 30414 will be open to serve all your banking needs. We appreciate your patience and understanding as we work to enhance our services for you! For more details visit www.tcbga.bank/remodel.

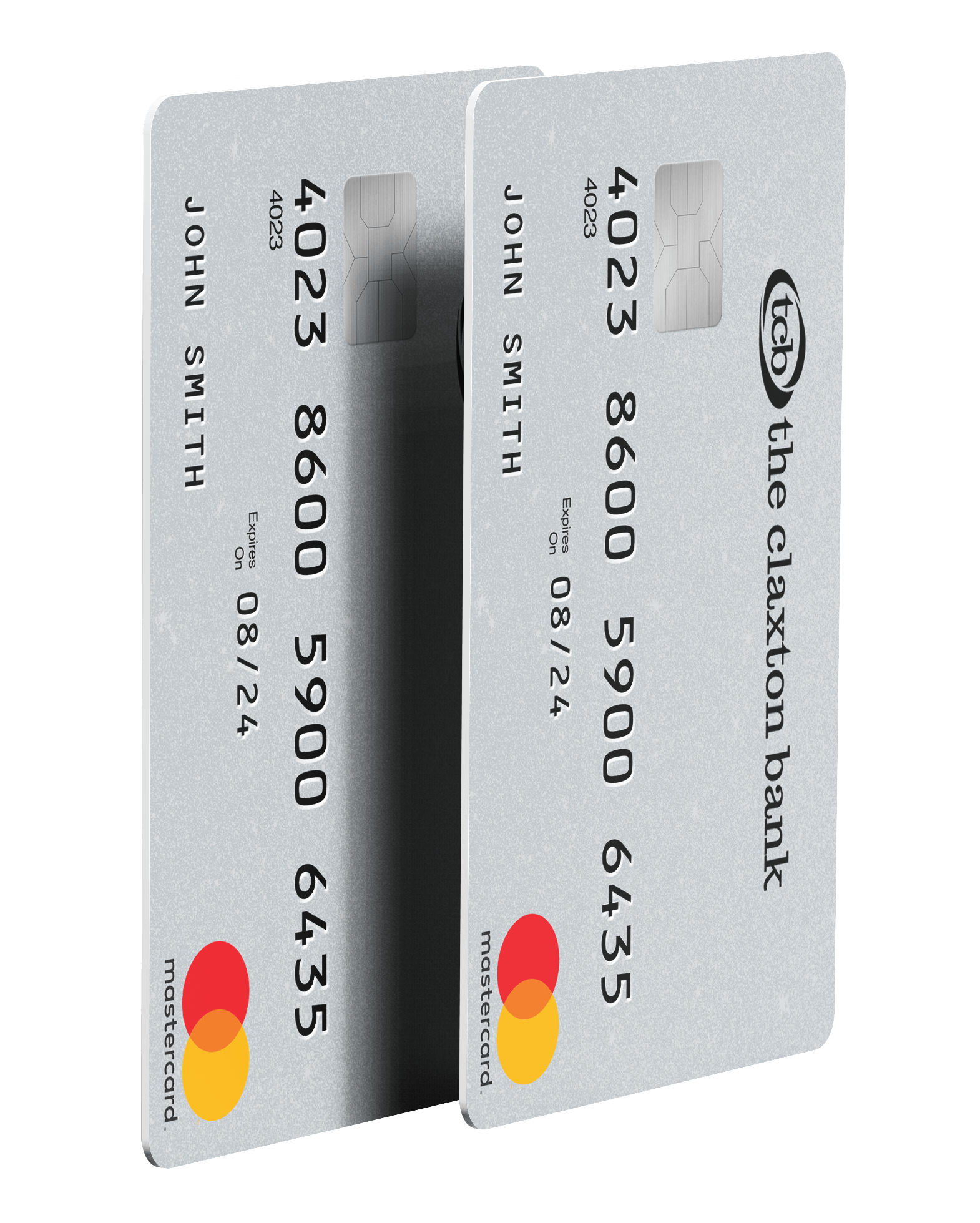

Personal Credit Cards

Reward yourself with a TCB Credit Card.

Multiple cards to choose from with rewards that fit your lifestyle.

Low Rate Card

Intro Rate of 2.9% for the first 6 months

Ongoing APR of Prime +6.99% 2

No Annual Fee

25 day Grace Period on all purchases.

No grace period for cash advances or cash equivalent transactions.

Mastercard® Platinum benefits include extended warranty protection, travel accident insurance, rental car collision damage waiver protection, and more.

Preferred Points Card

Intro Rate of 2.9% for the first 6 months

Ongoing APR of Prime +11.99% 2

No Annual Fee

Earn one point for each dollar spent up to 10,000 per month. Points can be redeemed for cash back, travel, merchandise, and retail gift cards.3

25 day Grace Period on all purchases.

No grace period for cash advances or cash equivalent transactions.

Mastercard® Platinum benefits include extended warranty protection, travel accident insurance, rental car collision damage waiver protection, and more.

World Card

Intro Rate of 2.9% for the first 6 months

Ongoing APR of Prime +11.99% 2

No Annual Fee

Earn one point for each dollar spent up to 10,000 per month. Points can be redeemed for cash back, travel, merchandise, and retail gift cards.3

25 day Grace Period on all purchases.

No grace period for cash advances or cash equivalent transactions.

Mastercard® World benefits include concierge services, extended warranty protection, travel accident insurance, rental car collision damage waiver protection, and more.

Consumer Credit Card Benefits

Consumer credit card holders receive a variety of exceptional benefits including the following:

Concierge Service

This service provides World MasterCard cardholders with comprehensive, personalized assistance accessible 24 hours a day, 365 days a year. The specially trained team is the single source for securing dinner reservations, tickets to events, coordinating business arrangements, locating hard-to-find items or booking travel.

Price Protection

Should you find a lower price for a new item within 60 days from the date of purchase using your eligible credit card, you may be reimbursed for the price difference.*

Baggage Delay Insurance

Reimburses you for replacing essential personal or business items in your baggage, if the baggage you have checked on to a common carrier is delayed in transit and your tickets were purchased using an eligible credit card.*

Car Rental Collision Damage Waiver Insurance

Pays for covered damages (physical damage and theft) to a rental vehicle when your eligible card is used to initiate and pay for the entire rental transaction.*

Extended Warranty

Doubles the original manufacturer's or store brand warranty for up to one year when you pay with your eligible credit card.*

Travel Assistance

Provides pre-trip destination information such as visa/passport requirements, immunization, and help with lost/stolen travel documents and luggage. Also provided are referrals to a network of physicians, arranging hospital transfers, and referrals to attorneys, local embassies and consulates, if you are traveling more than 100 miles from home.*

Roadside Assistance

Arranges emergency roadside assistance such as jump-starts, tire change, towing, and gas delivery if you get stuck on the road. Service fees are pre-negotiated and billed to your eligible credit card.*

Purchase Assurance

Provides coverage for most items you purchase with your eligible credit card if the item is damaged or stolen within 90 days of the date of purchase.*

Travel Accident Insurance

Covers you and your family against Accidental Death or Dismemberment if you purchase common carrier travel tickets with your eligible credit card.*

Don't Just Take Our Word For It

See what these actual customers have to say about banking with TCB, and this is just a few

★ ★ ★ ★ ★

★ ★ ★ ★ ★

Terms and Conditions:

Late Fee: $25 NSF Fee: $25

Cash Advance and Balance Transfer Fee: 3% of the cash advance or balance transfer amount, subject to a minimum fee of $10.

International Transaction Fee: 2% of the U.S. dollar amount of the transaction converted from the foreign currency.

1. All cards are subject to credit approval through TIB Card Services. Terms and conditions may apply.

2. After the introductory rate, the Annual Percentage Rate (APR) will vary based on changes in the Index, the Prime Rate (the base rate on corporate loans posted by at least 70% of the ten largest U.S. banks) published in the Wall Street Journal. The Index will be adjusted on the 25th day of each month or the business day preceding the 25th day if that day falls on a weekend or a holiday recognized by the Board of Governors of the Federal Reserve System. Changes in the Index will take effect beginning with the first billing cycle in the month following a change in the Index. Increases or decreases in the Index will cause the APR and periodic rate to fluctuate, resulting in increased or decreased Interest Charges on the Account. The Account will never have an APR over 21%.

3. Additional information about Mastercard and Visa cardholder benefits are provided on TIB Benefits Charts.